Maximize Tax Benefits with Smart Giving Tools

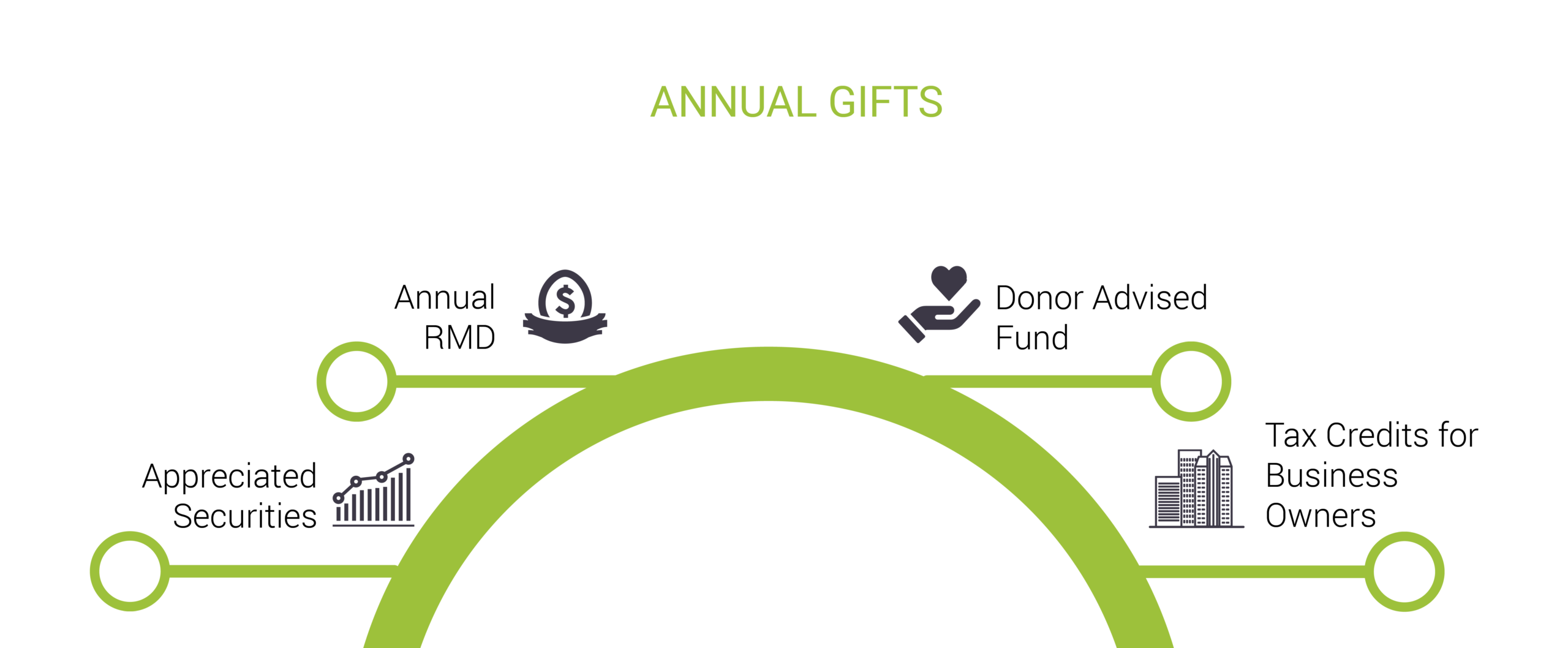

The season of giving is here, and United Way of Greater St. Louis is grateful for the community’s support. As the end of the year approaches, United Way invites you to consider taking advantage of one or more tax-smart charitable giving options.

A contribution today is more than a gift; it’s an investment in the well-being of our region. These tax-efficient tools can make your giving go farther and are a perfect complement to 2023 giving.

Appreciated Securities: Optimizing Benefits

Donating appreciated stock to United Way by December 29th may help you avoid capital gains tax and can be the perfect complement to your annual gift. Making a gift of securities gives you the chance to support the work of United Way while realizing a benefit for yourself. After the stock is transferred to United Way, we will issue a tax letter to you for the fair market value of your gift. Give your broker the account information below to execute the transfer.

Edward Jones

DTC #: 0057

Account #: 100-09948-1-2

Contact: Bob Zerega

Phone: 314-515-3129

Wells Fargo Advisors

DTC #: 0141

Account #: 6615-0314

Contact: Chris Kuhn

Phone: 314-991-7847

Qualified Charitable Distribution (QCD): Smart Solution for RMDs

If you take an annual Required Minimum Distributions (RMD) but don’t want to raise your taxable income, then donating your RMD directly to United Way may be a good solution. Donating your RMD can help you lower your taxable income. Your distribution must be sent directly to United Way of Greater St. Louis by your IRA administrator; otherwise, you must count it toward your taxable income.

Donor Advised Fund: Flexibility and Immediate Tax Deduction

If you contribute to a Donor Advised Fund (DAF) at any financial institution, you get an immediate tax deduction and retain the flexibility to give to United Way when the time is right for you.

Note: Donors cannot make or fulfill legally binding pledges using a DAF. However, many fund holders offer the opportunity to set up recurring gifts from a DAF. A letter of intent is all that is needed.

If you have a DAF at any financial institution, funds must be entered by the end of the year to enjoy the tax-saving benefits.

United Way of Greater St. Louis

910 N. 11th Street

St. Louis, MO 63101

EIN: 43-0714167

For more information on charitable giving options contact contact philanthropy@stl.unitedway.org or 314-539-4065. A United Way planned giving specialist will contact you.

United Way does not provide tax, legal or accounting advice. This material is for informational purposes only and should not be relied on for tax, legal or accounting advice. Please consult with your tax, legal and accounting advisors before engaging in any transaction.

Take action now:

- See additional Ways to Give.

- Learn about how your gift makes an impact.